ICE Contracts Explained: The Companies Enabling Mass Deportations

As immigration policies tighten under renewed enforcement efforts, companies face reputational risks for their role in mass deportations.

THE SITUATION

Since taking office, Trump has carried out 21 executive actions to overhaul the US immigration system, having made mass deportations of undocumented immigrants a central campaign promise. A nationwide immigration crackdown on Sunday resulted in the arrest of 956 people, the most since Donald Trump returned to office, according to Immigration and Customs Enforcement (ICE), with public officials expecting that number to rise.

The U.S. immigration enforcement system relies heavily on private corporations, with over $3 billion taxpayer dollars a year flowing into government contracts for detention, transportation, and surveillance at more than 200 immigrant detention centers. As immigration policies tighten under renewed enforcement efforts, companies face growing reputational risks and public backlash for their role in mass deportations and detention.

This newsletter breaks down what this means for investors, particularly which companies transact most with ICE and what risks these investments pose for investment portfolios.

OUR ANALYSIS

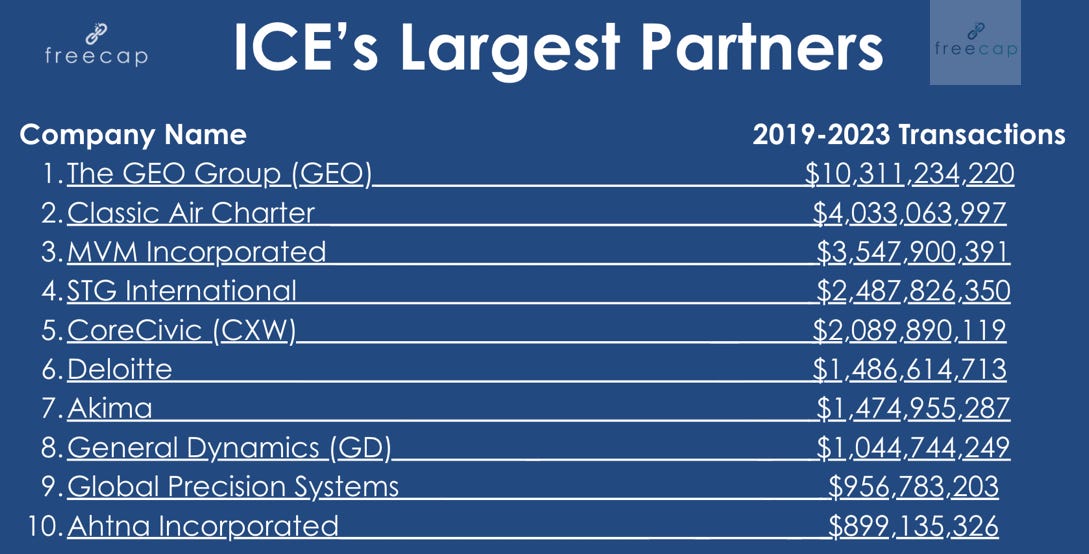

Listed are the top 10 companies with the largest revenue from Immigration and Customs Enforcement (ICE) between 2019 and 2023. Unsurprisingly, GEO Group (GEO) – a private prison company — tops the list. Classic Air Charter, MVM Incorporated, STG International, and CoreCivic (CXW) all had transactions exceeding $2 billion over those four years. The dollar figure is the total outlaid amount between 2019 and 2023, meaning the actual amount of money spent (or disbursed) by the U.S. government to the contractor.*

Private Prison Operators Lead the Way

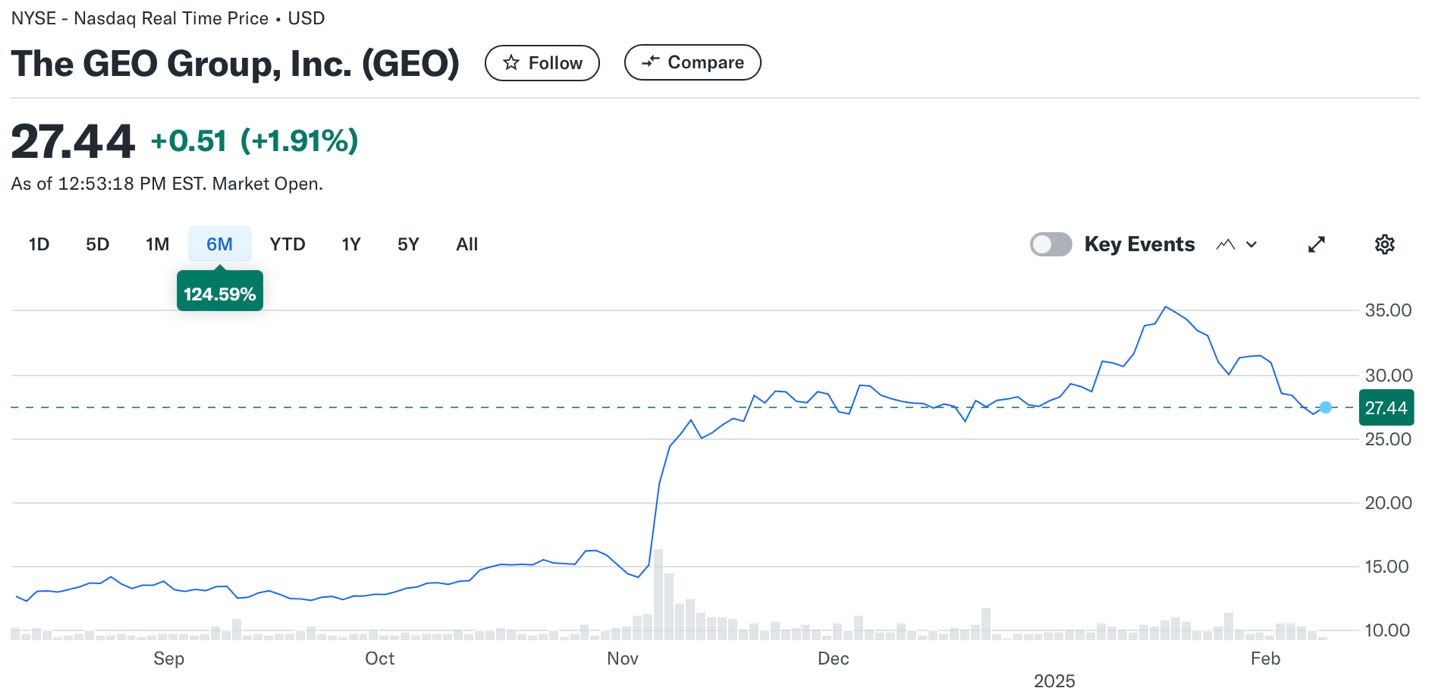

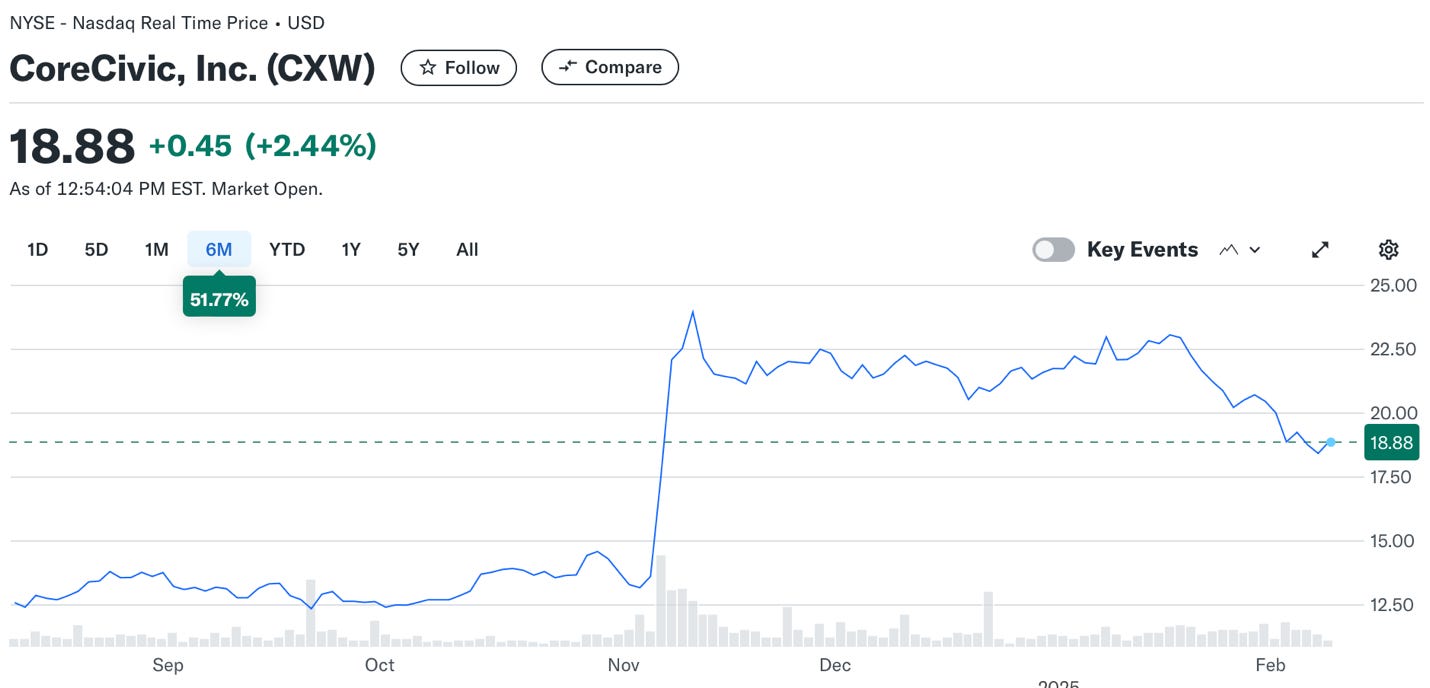

GEO Group and CoreCivic—the two largest publicly traded companies on this list—specialize in correctional services (i.e., owning and operating immigration detention centers and prisons). Their stock prices ballooned after Trump was elected, but can they sustain this level of growth?

Although both companies are branded as supportive of rehabilitation and protective of human rights, ICE pays GEO Group a per diem rate based on the number of immigrants they imprison, meaning their profit model is directly tied to the number of people they detain. Instances of abuse, forced labor, and neglect have been reported at private prison facilities, and in 2019, a backlash from activists forced many banks to end their financing relationship with these two companies, which led to a collapse in share price.

Most companies that contract directly with ICE, however, are privately held. For example, the second company on our top 10 list, Classic Air Charter, had transactions with ICE amounting to over $4 billion from 2019 to 2023. Classic Air Charter is a private aviation and aerospace component manufacturing company based in Florida. The company assists the Department of Homeland Security in transportation and lodging, likely the deportation of undocumented immigrants.

Only 18% of companies with more than $50M in vending contracts with ICE are publicly traded.** Here’s a brief list of corporations that match this criteria:

The GEO Group (GEO)

CoreCivic (CXW)

General Dynamics (GD)

CACI International (CACI)

Booz Allen Hamilton (BAH)

Palantir Technologies (PLTR)

Capgemini Government Solutions (CAPMF)

Science Applications International (SAIC)

WidePoint Integrated Solutions (WYY)

Dell Technologies (DELL)

Are you curious about what type of contracts these companies are providing to the federal government? Let us know in the comments section, and we’ll prioritize a case study report on it.

KEY TAKEAWAYS

Companies engaged in mass deportations will deepen their pockets in the short term but could face political and reputational backlash if public sentiment sours on Trump’s aggressive deportation policies.

As enforcement intensifies, companies contracting with ICE not only risk facing growing public backlash and reputational risks, but also financial risk as their growth relies on the continued expansion of detention centers. Public backlash plummeted the share prices of CoreCivic and GEO Group during the Trump administration's first term, and it’s possible we can see history repeat itself.

Additionally, GEO Group noted in its recent annual report that ICE contracts account for 43 percent of its revenues. CoreCivic reports that 30 percent of its revenue came from ICE contracts in its most recent annual report. A publicly traded company that relies on one client for over a third of its revenue should be a red flag for investors – this lack of diversity in revenue streams means the company's value can shift abruptly with changes in public policy. And even if you are betting on these companies to be big winners in the short term, what is the growth trajectory for a company that only grows by incarcerating more people? If Trump's mass deportation efforts succeed, won't the pool of potential detainees eventually shrink, thus putting these companies out of work?

What should you do if you are invested in one of the companies on this list? Next week, we’ll dive more into this question.

* This number typically lags behind the obligated amount because payments are made over time as the contractor meets milestones or submits invoices. The data was collected in the Fall of 2024 from usaspending.gov, and as this data is constantly updated, some numbers may be lower than the final amount. We compiled subsidiary companies and listed them under the parent company name, but some subsidiaries may not be captured in this list.

**Paid subscribers gain access to the full dataset of companies with $50M+ revenue generated from ICE contracts.